Banks or Funds

can profitably

drive the gold market down

by first buying puts or selling calls

or selling futures

then dumping large quantities of gold or gold stocks

in a short period of time.

Then buying in, or covering

at the new lower price level.

There will come a time

wen they cant driv th mkt dn any further,

cause *sentiment is at an xtrm*

and no one wil buy their protective calls

or sel them protectiv puts

and no one wil buy their future cntrts

so they will not be able t hedge

a large short position

in order t continu th driv dn.

Then th mkt must rise

as they cvr their shts,

in order to reset sentiment.

But there r xceptns eg.

an investment bank/broker

could driv prices dn

without shorting from their own acct

by selling out [redeeming] client shares:

“MORGAN STANLEY‘s Wealth platform unit has finally,

after months and months of considerations,

pulled the plug on the fund [A PAULSON & CO FUND] that for the second year in a row

is one of the three worst performing in the weekly HSBC report

and IS NOW REDEEMING.

What however is notable is that

MS withdrawing HUNDREDS OF MILLIONS in feeder capital

may well explain why gold has seen such a dramatic dislocation [ie BIG DROP]

in the past week.

Recall that at Paulson & Co, gold is not simply an investment –

the bulk of direct gold investments at the once legendary investor

are in the form of (largely underperforming) gold mining stocks –

but an actual investment class.

In other words, instead of being denominated in USD,

investors are actually denominated in (paper) gold,

with a fixed conversion into GLD at inception.

This means that upon liquidation of gold-denominated shares,

any gold-denominated shares,

he has no choice but to sell GLD,

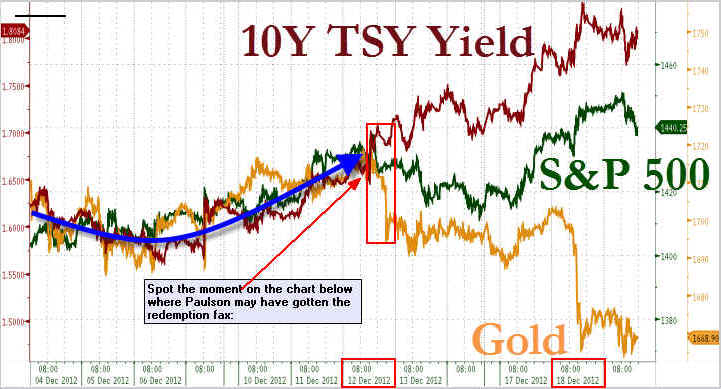

and by virtue of this being the most liquid paper instrument in the PM space, gold.“Does the massive gold dislocation [ie BIG DROP] in the chart below

now make more sense

especially since Paulson was aware of MS’ intentions days in advance and traded,

or in this case liquidated, appropriately)?”